Highlight

- COVID-Ball Gazing

- Holding up the mirror

- (Not so) smooth criminal

- The saga continues…

- Pipe up on corruption

- All eyes on debt China

- TAI Spotlight: What’s a donor collaborative? Here is what my internship at TAI taught me

COVID-Ball Gazing

Photo credit: Image by Gerd Altmann from Pixabay

What happens when you put 347 senior risk analysts in a room together? No, not a joke, but World Economic Forum did the virtual equivalent and Iman Ghosh has helped map the most likely global risks for the world in the next 18 months based on their collective brainpower. No surprise that economic risks dominate, but also significant concerns on the risks of cyberattack, loss of civil liberty, worsened inequality and government distrust. Enough to make you want to stay in bed and pull the covers over your head.

Speaking from the African context, Tax Justice Network–Africa’s Alvin Mosioma says the challenge of Africa’s development has become more apparent in the context of the COVID-19 crisis as many governments are living on budget deficits and are being forced to borrow. In the same vein, Aidan Eyakuze worries the COVID-19 may alter the social contract between government and citizens as inequality increases and trade subsides, but notes that the current changes could spark active citizenship. While billionaire philanthropist Mo Ibrahim says he is impressed with Africa’s response to the COVID-19, he worries about the frayed international order and the looming economic recession set to hit Africa – the first in 25 years. What gives him hope? Strong partnerships and the continent’s youth, resilience, and innovative spirit that can help drive recovery.

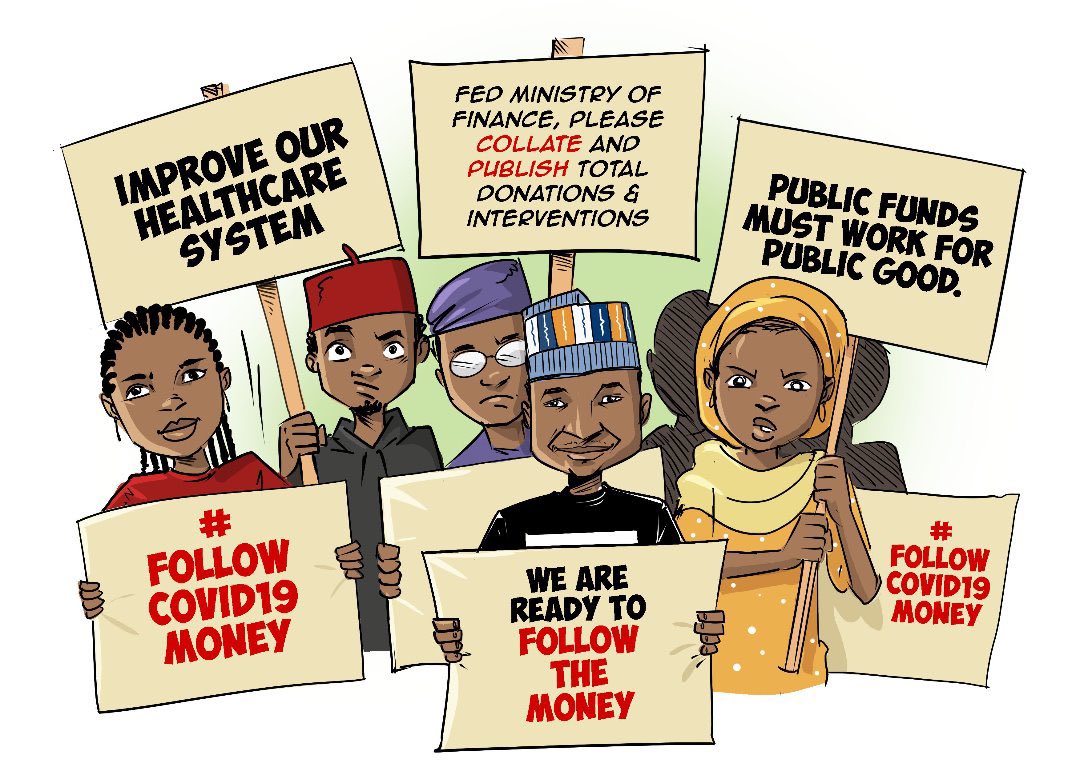

Hamzat Lawal urges the Nigerian Government to respect the Open Government Partnership (OGP) commitments as discretionary powers granted to combat COVID-19 under the guise of emergency protocols are becoming ruthless and undemocratic with officials resorting to intimidation of citizens and CSOs who are working hard to advance political accountability. He argues that COVID-19 should be an opportunity to “reset our politics, policies, economies and public health systems” and honouring the OGP commitments may be the tipping point for anti-corruption campaigning in Nigeria. No mention of OGP commitments in a speech by Michael Gove, head of the UK’s Cabinet Office, but interesting to note an emphasis on getting government “closer to the people”, reliance on data, and evidence for policy making and accountability. As governments shift rhetoric amid the current crises, will that translate into policy and practice?

Holding up the mirror

Image credit: Hamzat Lawal/ iFollowTheMoney

What about funder practice? Accountability Lab, CoST and Hivos made a joint call in an open letter for providers of development assistance to maintain support for transparency, accountability, and open government in the wake of the pandemic. (You too can add your voice). TAI’s Michael Jarvis makes a similar call to funders to step up – noting “It has never been more important for the public to be well-informed and empowered to hold their government accountable.”

What remit will TAI member DFID once merge with the UK Foreign Office? Too early to know, but Ian Mitchell lays out seven key points to consider to ensure the new department the best possible asset for Britain and its development partners. Chief among them: don’t cut aid during the pandemic, retain the same degree of expertise, and establish new parliamentary scrutiny and oversight structures.

On the private funder side, Langeloth Foundation is among the latest trends-setters to increase their payout from 5% to 10%. They are pivoting to prioritize civic engagement and participation in response to the current context and hoping more funders will do the same. Music to TAI ears.

Another foundation “rule” that may crumble in these exceptional times? Bipartisanship. Democracy Fund lay out why they are taking a more political stance. Joe Goldman explains how, “a commitment to ‘bipartisanship’ above all else is untenable when our political leaders openly embrace authoritarian politics and reject values like pluralism and the rule of law.”

Meantime, Philip Roje wonders if philanthropy organizations owned by billionaires will commit more to funding economic justice programs in the face of growing criticism of their ever-growing wealth during a recession as Baobá’s Selma Moreira and Fernanda Lopes laments on low racial equality funding in Brazil despite the country’s large black population. Plus, hear from Diversity, Equity, and Inclusion committee co-chairs at The Rockefeller Foundation on their plans for internal responses on racial equity as they call for changes in funding and advocacy support to advance racial justice. According to them, “being transparent about our institutional and personal shortcomings while working to overcome them is critical as we transform ourselves and our society.”

What of larger aid agencies? Stephen Kidd argues that “if black lives truly matter, donors should only fund and advocate for schemes that enhance human dignity and respect human rights; stop funding social protection schemes with practices that would never be allowed in their own countries” and that they would not participate in themselves.

Don’t think your global work addresses racial or other inequities? Start with this multi-media list of resources to build your own awareness and be better prepared for conversations to come in shifting power in international development work and organizations. Also, if you are interested in bringing more web accessibility to your nonprofit; check out this resource guide by MacArthur Foundation to help you establish more inclusive digital environments.

Image credit: Philanthropy and social movements

Essential Listening: Philanthropy and Social Movements

Listen to this impressive 10 part podcast series on US philanthropy and social movements courtesy Harvard Kennedy School. The Podcast Hosts are students enrolled in DPI-367: “Philanthropy and Social Movements: Will the Revolution Be Funded?” during the Spring 2020 semester at Harvard Kennedy School.

(Not so) smooth criminal

Last week we flagged the tax pain of the superrich due to COVID strandings. This week, we turn to those undone by their own connivance. In an event that would have given a Netflix TV show a run for its money, Russian tycoon Vitaly Malkin obscured his ownership of a $35 million luxurious ski chalet using a Luxembourg shell company – no doubt hoping to avoid France’s traditional wealth tax on the asset. Yet now, tax officials have cottoned on and, after a four-year court battle, Malkin has to pay a higher 3% tax on the value of the property. For governments needing every penny they can right now, it is a good prod to check Thom Townsend’s recommended steps to implement beneficial ownership transparency under COVID-19.

After a short trial involving a murdered judge, a Democratic Republic of Congo’s high court sentenced Vital Kamerhe, the president’s chief of staff to 20 years in jail and disqualified him from holding a public office for 10 years after he was found guilty of embezzling $48 million in public funds. In China, police in Beijing and Shanghai has arrested 10 people (among them senior executives and legal representatives) for illegally raising billions of Yuan through investment fund products backed by a web of closely held companies disguised as State Owned Enterprise.

Honors for biggest scandal of the week go to Wirecard. After brazen denials (and suing journalists), company leadership finally admitted that it cannot account for a missing $2+ billion. The CEO is arrested. The company files for insolvency. Eyes turn to auditor EY for their failure to do a basic asset check, and now Germany is severing ties with its accounting watchdog and considering more radical solutions. No better timing for pinpointing avenues for audit reform (see TAI member Luminate’s new call for expressions of interest – TAI Spotlight below)

The saga continues…

No, not Star Wars, but OECD led negotiations on digital tax. Hopes for a global framework deal took another blow after the United States rejected plans they believe overly targets tech giants like Google, Facebook, and Apple. OECD Secretary-General Angel Guirria warns that without a multilateral solution, “more countries will take unilateral measures… This, in turn, would trigger tax disputes and, inevitably, heightened trade tensions. A trade war, especially at this point in time, where the world economy is going through a historical downturn, would hurt the economy, jobs and confidence even further.”

No surprise that the EU is already moving on with its own plan. What path will other regions and countries back? Mustapha Ndajiwo argues that the main problem of taxing highly digitalised businesses is not their lack of taxable presence in African countries but the attribution of profits. He urges African countries to build on the G24 proposal under the Inclusive Framework on BEPS, and press for simple formulaic methods which would allocate profits fairly between countries based on real activities in each.

Turning back to the current fiscal emergency, the Independent Commission for the Reform of International Corporate Taxation (ICRICT) has also proposed five ways for a sustainable recovery from the global pandemic. What of inequality dimensions? Could consumption taxes may be more palatable than thought? Recent research suggests setting a uniform rate on all goods decreases inequalities by as much as the total effect of income taxes and social security in our sample. Pierre Bachas, Lucie Gadenne and Anders Jensen reveal that “consumption taxes are substantially more progressive in developing countries than many believe” as poorer households spend more of their income in the untaxed informal economy.

Essential Resource: What does it mean to be a learning organization focused on transparency and accountability issues? New insights from the Learning Collaborative

Essential Resource: What does it mean to be a learning organization focused on transparency and accountability issues? New insights from the Learning Collaborative

Last year saw the wrap up of an experimental learning collaborative among transparency and accountability groups committed to being effective learning organizations. The insights among these hub organizations and efforts to test learning practices with a broader network of peers are now brought together in one place (courtesy of Dejusticia, host of the project coordinating team). Find lessons on how learning practices can contribute to more effective programming; how collaborations between academics, researchers and practitioners can better support learning organizations in the global south; and more!

Pipe up on corruption

EU regulators are calling for changes in trans-European energy infrastructure regulation following a Global Witness investigation of how gas companies have been pocketing billions while pushing for EU subsidies that they stand to benefit from.

Natural Resource Governance Institute’s modeling of Tanzania mining tax code reveal that the reintroduction of value added tax refunds for mineral exports better aligns its tax level with other countries, while maintaining a fiscal regime that should still generate significant government revenue.

The Extractive Industries Transparency Initiative published their impact assessment report, and offer some thoughtful reflections on the struggle to measure the impact of a global initiative with 53 country members each with their own unique resource governance contexts. A shift to user-centric M&E is in the works. Look for more details on evaluation evolutions after the October board meeting.

From underground to oversea governance challenges. The Maritime Anti-Corruption Network (MACN), a global business network working together to tackle corruption in the maritime industry, is expanding its Collective Action initiative in Nigeria with the support of the Siemens Integrity Initiative. The new funds will “enable port users to demand, track, and ensure greater compliance in Nigerian ports, help strengthen government capability to establish compliance systems and collaboration between business, government and civil society.”

All eyes on debt China

Who owes what to whom and how much debt service are developing countries expected to pay to each creditor? Masood Ahmed share insights from the World Bank’s Debt Service Suspension Initiative (DSSI) country-by-country data on debts owed by 73 low-income countries. He applauds this move as “a welcome contribution to enhancing transparency” and proposed a month-on-month update of the data to maintain and sustain momentum on public scrutiny. Unsurprisingly, China is the largest bilateral creditor and at long last, we can put a dollar amount on how much countries owe China (Angola, Ethiopia, Laos, Kenya, and Pakistan are top debtors).

Ma Tianjie provides insight into Chinese thinking on the thorny issue of how China will manage distressed external debt. Possible options cited include extensions, write downs, forgiveness, debt2equity, and turning dollar-denominated debts into RMB. Meanwhile, Jan Van de Poel, Nerea Craviotto report on the OECD’s Development Assistance Committee’s (DAC) meeting this week, highlighting why debt relief shouldn’t be considered official development assistance.

TAI Spotlight: What’s a donor collaborative? Here is what my internship at TAI taught me

What’s a donor collaborative? Here is what my internship at TAI taught me | Transparency and Accountability Initiative (TAI)

Wondering what it is like to work in a donor collaborative? Our student fellow, Michael Hariman shares his experience and learnings.

Call for action on audit reform | Luminate

Following the publication of the Auditing with Accountability report, which highlights the lack of attention paid to audit reform and the likelihood that reform measures will be greatly diluted; Luminate has launched a call to push for much-needed reform

Are you willing to give up your privilege? | Ford Foundation

In a New York Times op-ed, Ford Foundation President, Darren Walker argues that capitalism must be reformed if we are to save democracy and challenge inequality.

A better way to practice philanthropy| MacArthur Foundation

President of Candid, Bradford K. Smith, shares how the Solutions Bank has the potential to reshape philanthropy to be more open, efficient, and democratic. The Solutions Bank contains more than 450 proposals that were submitted as part of MacArthur’s 100&Change competition.

Empowered refugees lead the way | Open Society Foundations

Open Society Foundations’ Khairunissa Dhala spoke with John Jal Dak, the founder of refugee-led organization Youth Social Advocacy Team, based at the Rhino Refugee Camp in Uganda, about the work he does to strengthen his community against COVID-19.

Fighting corruption to achieve the SDGs | Chandler Foundation

The Chandler Foundation hosted The World Bank Group, Organized Crime and Corruption Reporting Project, Open Government Partnership and Ford Foundation to discuss the explicit link between corruption and prosperous societies. Watch the recorded session here.

Alvin Mosioma: As foreign aid dries up, African governments must increase revenue through taxes | Hewlett Foundation

In the latest edition of the “Coronavignettes” series produced by Hewlett Foundation TPA team, Executive Director of Tax Justice Network Africa (TJN-A), Alvin Mosioma spoke on the fiscal impact of COVID-19, the need to close tax loopholes, and how African governments can address a decrease in foreign aid.

Job listings

- Job postings at Ford Foundation – Ongoing

- Job postings at Luminate – Ongoing

- Job postings at Democracy fund – Ongoing

- Job postings at Wikimedia Foundation – Ongoing (and mostly remote)

- Government Affairs Senior Policy Advisor, International Financial Institutions at Oxfam – Ongoing

- Director of Development and Solidarity Philanthropy at Grassroots International – Ongoing

- Senior Communications Coordinator at Grassroots International – Ongoing

- Reset. Information control fellowship – July 1, 2020

Reset. Resident fellowship – July 1, 2020 - Open Contracting Partnership, Head of Advocacy – July 14, 2020

- Open Contracting Partnership, Community Manager – July 20, 2020

Calls/Opportunities

- BetterTogether Challenge for innovators – Ongoing

- Call for research proposals: Tax and civil society [No Deadline]

- Free Digital Security Training – Ongoing

- Open Road Alliance Charitable Grant and Loan to organizations responding directly to COVID-19 – Ongoing

- Call for submissions to SSIR Series: Social change in an era of extreme polarization – Last Thursday of every month until early 2021

- Pulitzer Center Coronavirus news collaboration challenge – Applications will be reviewed on a first-come, rolling basis

- Call for proposals: Informality, tax, and the state – Proposals accepted on a rolling basis

- Change Leaders in Philanthropy Fellowship – (application opens on June 2020)

- Call for papers: Are emergency measures in response to COVID-19 a threat to democracy? – June 30, 2020

- Proposal: Working together to improve governance and anticorruption (Central and Eastern Europe focused) – June 30, 2020

- Reset our future fund for organizations and people using technology, research, and education that help tackle these challenges – July 1, 2020

- Apply for the Reset Surveillance Capitalism Fellowship before July 1

- IBM call for Code Covid-19 Global Challenge – July 31, 2020

- Amartya Sen essay contest 2020: Illicit financial flows – August 31, 2020

Calendar

- Transparency International: 19th International Anti-Corruption Conference – (Postponed)

- The State of Global Human Rights – June 24/25 (Depending on time zone) 8pm ET US.

- 2020 Neighborhood Funders Group National Convening (philanthropy support to grassroots power building) – June 29 – July 1, 2020 (Washington, DC)

- OECD – Tax Transparency in Africa – June 25, 2020 (Online)

- Can we end corruption in oil, gas, and mining? – July 1 4-5P EDT (Online)

- WE EMpower UN SDG Challenge 2020 – September 18 – 27, 2020 (New York City, United States of America)

- The 2020 Journalism Funders Gathering (funder-only gathering) – October 6-7, 2020 (Philadelphia, United States of America)

- Humanitarian and Development Data Forum – November 2-4, 2020 (Chambery, France)

- International Open Data Conference –November 18-20, 2020 (Nairobi, Kenya)