The Addis Tax Initiative conference is due to start in Berlin next week and one aspect we hope to draw attention to is civil society and the role it can play in boosting domestic resource mobilization (DRM). TAI is excited to partner with the ATI and Save the Children on a session dedicated to civil society efforts in DRM and launch new research carried out by the Overseas Development Institute (ODI) for TAI and Save the Children’s own research. ODI’s research aimed to answer a few key questions: what is civil society’s appetite to work on tax? What could more effective donor support look like?

The Addis Tax Initiative conference is due to start in Berlin next week and one aspect we hope to draw attention to is civil society and the role it can play in boosting domestic resource mobilization (DRM). TAI is excited to partner with the ATI and Save the Children on a session dedicated to civil society efforts in DRM and launch new research carried out by the Overseas Development Institute (ODI) for TAI and Save the Children’s own research. ODI’s research aimed to answer a few key questions: what is civil society’s appetite to work on tax? What could more effective donor support look like?

A key limitation of civil society engagement on tax reform has been resourcing, as in 2015, only 3% of DRM funding went to local civil society. Few bilateral and multilateral agencies directly support civil society, as most resources have gone to revenue authorities (the Norwegian development agency, Norad, has been a significant exception). This funding gap has enabled private funders, like some of TAI’s members, to be key players in this space.

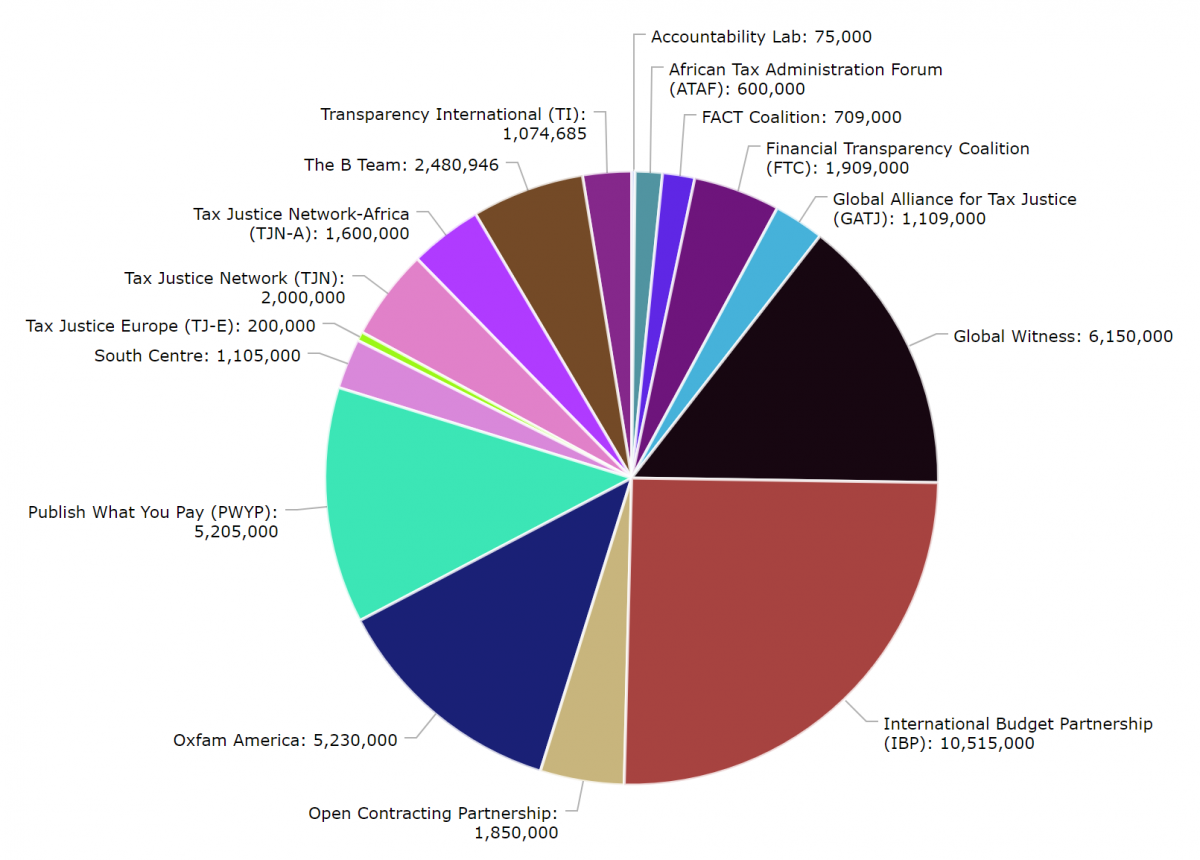

In time for next week’s event, we’ve updated our tax map showing which groups TAI members fund on tax work (in US dollars). On our tax minisite, you can see TAI member theories of change on tax reform, a breakdown of the tax ecosystem, and some background on the grantees shown here.

Of our members, Hewlett and Open Society Foundations fund the most on civil society tax work, at $14.9m and $14.6m respectively. But it’s important to note that as funder strategies change, so too does the funding landscape. For example, Wellspring Philanthropic Fund has recently started its first grants on tax work while Ford’s recent strategy refresh has seen tax work rolled into work on Natural Resources and Climate Change, as opposed to a stand-alone issue.

Of our members, Hewlett and Open Society Foundations fund the most on civil society tax work, at $14.9m and $14.6m respectively. But it’s important to note that as funder strategies change, so too does the funding landscape. For example, Wellspring Philanthropic Fund has recently started its first grants on tax work while Ford’s recent strategy refresh has seen tax work rolled into work on Natural Resources and Climate Change, as opposed to a stand-alone issue.

That said, this graph does have some caveats. For one, this map counts total grant amounts for any grant that is active during or after January 1, 2019. So, for example, if a grant for $300k ended on December 31, 2018, it isn’t reflected in the chart.

This map doesn’t show all grantees working on tax, just a few of the bigger players. Additionally, this graph only shows funding from our members, not other funders. Finally, not all of the funding on this graph is for tax work. For example, while International Budget Partnership receives roughly a quarter of all funding represented, they only recently started tax work.

From this graph, it’s quite evident that large INGOs are soaking up a lot of the funding. That’s far from a bad thing, however, as there is plenty of interest from INGOs to do more tax work with local level groups. Working with smaller, locally-based actors can pose large challenges to funders, such as conducting due diligence, and it may be difficult for local CSOs to meet stringent donor requirements. Yet, as the ODI report will show, local civil society actors do have an important role to play in DRM efforts. As donors convene for the ATI, we hope to highlight civil society’s unmet potential as donors aim to help countries boost revenues.